Governor Glenn Youngkin’s package of proposed tax changes is now stalled in both the Virginia Senate and the House of Delegates. A House subcommittee spiked it Feb. 5 and then dashed other bills imposing major tax increases on higher income Virginians.

Of course, anything is possible until the General Assembly adjourns in March, but it seems only two major tax increase proposals are still viable in the 2024 Assembly.

The first would allow all Virginia cities and counties to add an additional 1% to the sales and use tax within their borders for school spending if a local referendum approves it. & Current law has allowed that in eight counties and one city, but this bill would expand that to the entire state. It is advancing in both chambers.

The second, not usually discussed as a tax hike, is the proposal for a new state trust fund to provide weekly payments to employees taking family or medical leave from work. The bill calls for a payroll tax to fund the benefits but does not specify a tax rate or indicate just how much of an employee’s wage would be taxed. The Virginia Employment Commission based its fiscal estimates on a tax of just under 1%.

Bills creating this new state-paid family and medical leave benefit program are now in the budget committees of both chambers, and they have until February 18 to reveal their budget amendments. This program could easily become a $1-2 billion annual entitlement. The underlying federal Family and Medical Leave Act (FMLA) provides no income replacement, just up to 12 weeks of job protection for covered absences.

The Republican governor’s tax package and most of the other proposals are being continued to the 2025 session and may be taken up for study in the interim. Secretary of Finance Stephen Cummings was in the meeting before the vote on Monday, arguing that Virginia’s economic competitiveness is eroding, and tax policy is driving some Virginians to relocate to other states.

The bill was also supported in testimony by the Thomas Jefferson Institute for Public Policy, the National Federation of Independent Business, and the Virginia Manufacturers Association. An economist from Old Dominion University backed up the numbers on population loss and Americans for Tax Reform detailed the list of other states cutting taxes. Virginia need only stand still to become a higher tax state.

The governor’s bill made slight cuts in the existing income tax rates, still leaving the top tax rate at more than 5% — far higher than the states seeing population booms. On the other hand, his bill would also have increased the sales and use tax by another 1%. And it proposed to expand the items subject to the sales and use tax to include more digital goods and services, things now not taxed.

The income tax changes produced a big tax cut of greater benefit to those with greater taxable income. The sales tax rate increase and the expanded tax base took much of that benefit back. The net result, according to its fiscal impact statement, was an overall tax cut of about $460 million in the next two-year budget.

In the governor’s proposed budget, he assumed the tax cuts would pass. Killing the Youngkin tax bills means the House and Senate budget writers now have $460 million more to spend in their proposed budgets.

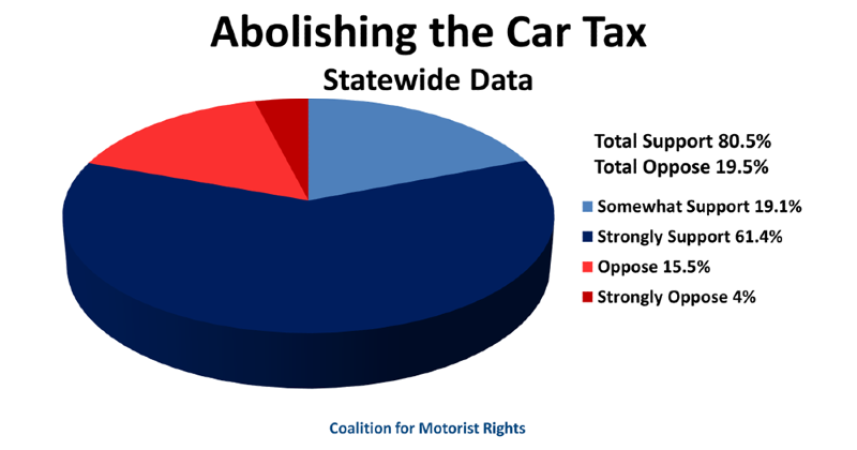

Another House subcommittee, meeting a week earlier, had already dispatched a bill to eliminate the local personal property tax on cars. That was another priority of the governor’s but not one he included in his proposed budget.

Democratic members of the House committee that carried over the income and sales tax bill Monday were dismissive of Cummings’ claims that Virginia’s economy is suffering and even disputed the evidence that Virginia is suffering a net loss of population. They stood firmly on the same ideological ground when, earlier in the same meeting, Republicans warned that bills to increase the income tax on higher incomes would also encourage migration.

One of those bills, which drew a parade of endorsements from progressive organizations, proposed a new tax bracket for filers with taxable incomes above $1 million. The new 10% tax rate would bring in a steady $1.5 to $2 billion more per year, according to its fiscal estimate. The patron and others argued that few, if any taxpayers would flee to lower tax states despite recent evidence that since the pandemic, high income families increasingly move to lower tax states

The second bill, introduced by House Finance Committee Chair Vivian Watts (D-Fairfax), proposed a more modest 7% top tax rate, but at a lower income trigger of $600,000. She indicated she was trying to match the top tax bracket for federal taxes. Despite it affecting more taxpayers, with the lower rate, it produced about half the revenue of the other bill, $500 to $700 million per year.

Perhaps because of the lower rate, the same progressive organizations that enthusiastically testified for the 10% bill were absent from the podium when Watts’ 7% bill was discussed. Only the Virginia Education Association spoke for both. Not interested in the 7% bill were the Commonwealth Institute for Fiscal Analysis, Voices for Virginia’s Children, the Virginia Poverty Law Center, and others.

It did not matter in the end. The two income tax hike bills, both of which included provisions to direct the extra revenue to popular programs (child tax credits, family caregiver tax credits, local schools), suffered the same fate as the governor’s. They were carried over until 2025.

So was another progressive priority that received the same host of endorsements during the meeting, a bill to reinstate Virginia’s estate tax. It was to be applied only to estates also subject to the federal tax, which means no tax on estates smaller than $13.6 million. Above that, a 16% tax rate would apply, and was estimated to produce $60 million in added revenue. As was the pattern with the income tax increases, the bill sought to dictate how the funds would be spent.

The House subcommittee even punted on expanding Virginia’s existing earned income tax credit (EITC) to allow a state credit equal to 20% of the allowed federal credit. The bill would have made the credit “refundable,” meaning beneficiaries with little or no actual tax owed would get a check from the state instead. The impact estimate on that was only about $30 million per year.

So, the progressive wave that swept in Democratic control of the Assembly may produce few tax ripples, except for a possible FMLA payroll tax which would be significant. But it was sufficient to drown the governor’s aspirations for a third session with at least some positive tax developments.