During Governor Glenn Youngkin’s budget submission to the General Assembly, he called for the elimination of the single most hated tax in the Commonwealth — the car tax.

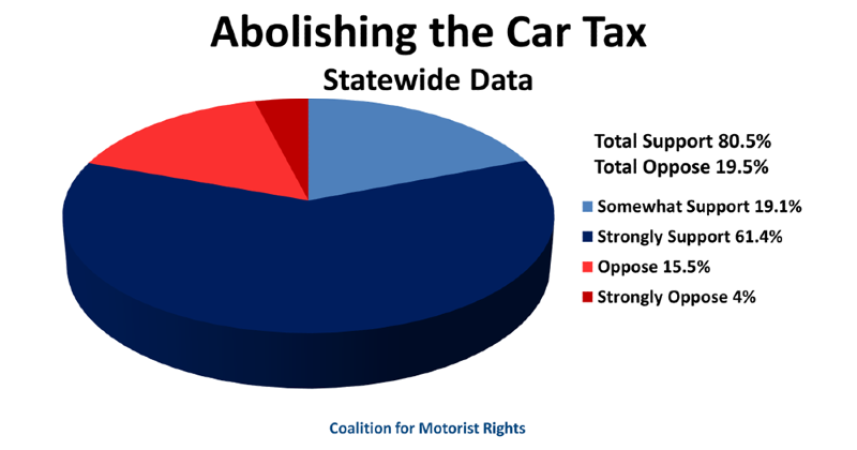

He is right, the car tax is very unpopular. Back in 1997, Jim Gilmore made the elimination of the car tax the center of his long-shot campaign for Governor and it propelled him to an easy victory. A recent survey by the Coalition for Motorist Rights found that 80.5 percent of Virginians are in favor of eliminating the car tax, with 61 percent strongly supporting its elimination.

It is not surprising that there were 32 candidates for state office (some from both parties) in favor of eliminating the car tax. One wonders what the election outcomes might have been had Governor Youngkin made eliminating this tax a part of his election strategy to keep the House and flip the Senate. Clearly, it was a missed opportunity.

Unfortunately, replacing needed revenue remains the biggest impediment to its elimination and is the reason the car tax remains today. While Governor Gilmore passed a phase-out of the car tax in 1998, due to an economic downturn, the General Assembly limited the car tax cut to 30 percent (which still makes it the highest in the country). While Virginia has an overall tax burden that ranks 23rd in collections per capita according to the Tax Foundation, it has the highest “car tax” rate in the country, according to a recent study by WalletHub. Car tax rates vary across Virginia from $3.40 per $100 in Henrico County to $5.33 per $100 in Alexandria. The rates are highest in Northern Virginia and lowest in Southwest Virginia.

The economic case for repeal of the car tax is pretty simple, as it is easily one of the most regressive taxes levied by states. Since the assessed value of cars tends to decline at a slower rate than income, particularly for older vehicles, the burden of the car tax falls more heavily on lower-income individuals who rely on older vehicles for transportation. In Virginia, with a significant rural population and a large number of households grappling with economic hardship, this tax hits hard.

The car tax discourages vehicle ownership, potentially hindering economic mobility and job opportunities for those reliant on personal transportation — especially in rural areas where public transportation is sparse. Repeal of the car tax should also appeal to the Green Agenda community, as high car taxes are a disincentive to replacing old gas-guzzling, carbon-producing vehicles with newer more energy-efficient cars.

The debate surrounding Virginia’s car tax reflects a broader national conversation about the efficacy and fairness of different tax systems. Governor Youngkin jumped into the middle of that debate today when he pushed for dramatic reductions in income taxes as a part of his budget, offset in part by increases in various sales and use taxes. Again, the economic case for this shift is sound as outlined in the Tax Foundation’s study, “Not All Taxes are Created Equal” which noted that “sales taxes are less distortive than capital and income taxes because they do not affect decisions to work or invest, and when appropriately structured, they do not lead to tax pyramiding or changes in consumption.”

Because the car tax repeal was not actually a part of Governor Youngkin’s budget proposal today (it was just a mention), movement on this proposal will require a supportive General Assembly to move the legislation outside of his budget. It will also require that the tax proposals Governor Youngkin did include in his budget (lowering income taxes across the board while modernizing the tax code to shift to greater reliance on sales and use taxes) get passed. Of course, it would also help if we had revenue in excess of expenses, as we have had the last two years.

The Thomas Jefferson Institute has a long history on how to eliminate the car tax and wrote a paper twenty years ago, “Car Tax Cuts: How Should Localities be Reimbursed?” that made an attempt to tackle the hardest challenge of its elimination — namely, how to make localities whole. More broadly, the Thomas Jefferson Institute has repeatedly called for a wholesale restructuring of the Commonwealth’s tax code, not dissimilar to what was proposed by Governor Youngkin today. We believe Governor Youngkin is on solid footing and look forward to supporting this effort as more details become available.

The greater danger, of course, is that the new Democrat majorities in the General Assembly will limit any income tax reductions the Governor requested, support the increases in sales and use taxes he proposed, and outspend the Governor in all of his new spending requests, and add their own spending on top of his proposals. Governor Youngkin will need to sharpen his veto pen to avoid this scenario. There can be no allowance for increased sales and use taxes if there isn’t an offsetting reduction in income taxes as he proposed!

- The Stealth Tax Increase that Remains in the Virginia Budget - May 15, 2024

- Convenience Stores Will Continue to Flourish Without Skill Games - May 14, 2024

- Virginia’s Paid Family and Medical Leave Act Deserves a Veto - April 1, 2024