The 2020 General Assembly, with its new progressive Democratic majority, passed nearly two dozen changes in Virginia tax laws that will begin to hit individuals and businesses in a few weeks on July 1. Because of the COVID-19 economic shutdown, a few amendments were made to the implementation schedule during the reconvened session on April 22, but no tax increase was repealed.

This is a follow up on an earlier report on the sixteen tax bills that passed the regular session. Most are taxes that will be buried almost invisibly in various transactions, and their phased imposition will also keep many taxpayers from noticing them.

July 1, 2020

- The statewide tax on gasoline increases from 16.2 cents per gallon to 21.2 cents per gallon (a 31% increase) and is no longer tied going forward to the rise or fall of wholesale cost.

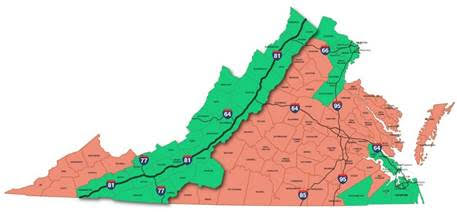

- The 7.6 cents per gallon added regional tax on gasoline, now imposed in Northern Virginia, Hampton Roads and along the I-81 corridor (see map), becomes a statewide tax. The total gasoline tax, statewide and regional, goes to 28.8 cents per gallon everywhere. That is a 21% increase where the regional tax already existed, and a 78% increase where it did not.

The green areas are regional transportation districts where additional fuel taxes are already being collected, 7.6 cents per gallon on gasoline and 7.7 cents per gallon on diesel. Effective July 1 those regional fuel taxes will be imposed in all the other Virginia localities. In combination with the 5 cent per gallon increase in the statewide gasoline tax, the total tax on fuel goes to 28.8 cents on gasoline and 27.9 cents on diesel.

- The existing 7.7 cents per gallon added diesel fuel tax in those same regions is also expanded statewide. The base statewide diesel fuel tax is already 20.2 cents per gallon and does not change on July 1. So outside of the existing transportation regions, the total 27.9 cents per gallon combined tax represents a 38% increase.

- The state tax on cigarettes rises from $3 to $6 per carton, a 100% increase.

- The state tax on other tobacco products (snuff, pipe tobacco) rises from 10% to 20%, a 100% increase.

- A new tax of 6.6 cents per milliliter is imposed on liquid nicotine products used for vaping.

- Counties without a tax on prepared meals may impose one, unless rejected in a recent referendum. (The county must wait until six years after a failed referendum.) The maximum allowed tax rises from 4 to 6% (a 50% increase), so some existing meals tax rates may rise.

- Counties may impose a local tax on admissions to movies, concerts and other amusements.

- Additional grantor’s tax on real estate transactions is imposed in the Hampton Roads Transportation District for transportation uses.

- Higher taxes on public utilities may be imposed to fund operations of the State Corporation Commission (taxes which eventually are passed on to consumers.)

- A tax of $1,200 is imposed on those ubiquitous “games of skill” machines. The Assembly had originally voted to ban them, but the machines were reprieved at the reconvened session and taxed to create a fund for COVID-19 expenses.

- Eight localities are authorized to call referendums on increasing their sales and use taxes an additional 1% to pay for school projects. They are Henry, Charlotte, Halifax, Mecklenburg, Pittsylvania, Gloucester and Northampton counties, and the City of Danville.

October 1, 2020

- The Central Virginia Transportation Authority is created. The regional fuel taxes imposed on July 1 are diverted to its control, and an additional 0.7% general sales tax (to 6%) is imposed on that date in: Counties of New Kent, Charles City, Hanover, Henrico, Chesterfield, Powhatan and Goochland, the City of Richmond and Town of Ashland.

- A peer-to-peer vehicle sharing tax, similar to the current vehicle rental tax, is imposed. Peer-to-peer sharing is like Airbnb for cars.

January 1, 2021

- All localities are authorized to impose a 5-cent tax on plastic bags, by local ordinance.

- Electricity generators begin to pay a carbon tax on emissions from fossil fuel plants, costs which will eventually be passed directly on to consumers. The amount of tax will be set by an auction.

- All customers of the major electricity providers (Dominion Virginia Power and Appalachian Power) begin to pay a usage tax on their electric bills to fund the new Percentage of Income Payment Plan, providing subsidized electricity to certain low-income customers. The amount will be set in a State Corporation Commission proceeding.

May 1, 2021

- Any county not yet collecting a transient occupancy tax may do so.

- Existing transient occupancy taxes are raised in the Hampton Roads and Northern Virginia transportation regions for transportation uses, and the existing grantor’s tax for transportation is raised in Northern Virginia.

July 1, 2021

- The tax on gasoline rises another five cents to 33.8 cents per gallon, another 17% increase.

- The tax on diesel fuel rises another 6.8 cents to 34.7 cents per gallon, another 24% increase.

- Any county without one may impose a local cigarette tax. Existing local tax rates are grandfathered, and new taxes limited to $2 per carton.

July 1, 2022

- The statewide taxes on gasoline and diesel fuel begin to rise annually based on the consumer price index.

Stephen D. Haner is Senior Fellow for State and Local Tax Policy at the Thomas Jefferson Institute for Public Policy.

E-Mail this author

- Trump’s Energy Promises Face Hurdles in Anti-Hydrocarbon Virginia - November 20, 2024

- No, RTD, Hurricane Helene Not Proof of ‘Climate Change’ - October 3, 2024

- A Transparent Effort to Increase General Assembly Authority to Eliminate Hydrocarbon Fuels - September 26, 2024