The fight that is about to occur at the Assembly’s reconvened session on Wednesday is entirely about taxes, not about spending.

An analysis of Governor Glenn Youngkin’s proposed compromise budget – done by the Democrats’ favorite financial bean counters, not by conservatives – confirms his budget comes extremely close to the spending levels Democrats approved at the end of the General Assembly. The gap compared to the $188 billion overall budget is little more than a rounding error.

For K-12 education, the gap between the two budgets is a few hundred million dollars out of an overall education budget of $24 billion. As you review the list of detailed comparisons made by the Commonwealth Institute for Fiscal Analysis, item after item is the same as in the budget approved in March. That includes funding for healthy teacher and state employee raises the Democrats were so proud to include.

In other cases where the Democrats expanded spending, the Governor accepted 50-75% of what they approved. He pays for some capital projects with debt instead of cash and utilizes money from the Literary Fund for retirement premiums, both legal and common strategies used in the budget for decades. Governors of both parties have done those often.

On the other hand, while the General Assembly refused $1 billion in new discretionary spending sought by the Governor, he is seeking to restore just $230 million of it, mostly in education and economic development.

If Democrats refuse all or most of the Governor’s 242 proposed budget amendments, it will be because they want to hold the Virginia state government hostage to a potential shutdown for a tax increase.

The major tax hike the Democrats included in their budget and seek to restore is an expansion of the sales tax to digital goods and services, including purchases by Virginia businesses.

Even with that tax stripped out, and previous tax changes in 2022 and 2023, Youngkin’s budget 2.0 is 52% larger than the $123 billion overall budget Democrats approved four years ago when they had total control. The General Fund portion has grown 45% in just four years, from $44 to $64 billion. Yet the political left and its allies are exploding in rage that he is “slashing crucial funds” and “jeopardizing the future of our children.”

Faced with a budget based on a tax increase he opposed, the Governor had several options. He could have vetoed the budget entirely, forcing a special session to write a new one. He could have vetoed the sections that imposed the tax, likely to spark a test in court over the extent of his veto powers. He could have put all his proposals into a Governor’s Substitute, leaving the Assembly with just one vote to take on the whole package.

By offering his budget objections as a series of amendments, he took a path that makes it possible to adopt a budget on time. This path also leaves the Governor the ability to review the results of the reconvened session before deciding whether to sign the budget or opt to issue a veto. The Governor’s approach retains flexibility for both him and the legislature.

While there is a dizzying total of 233 amendments, plus nine to House Bill 29 amending the budget for the current fiscal year, not all of them are likely to be equally important to the Governor. Some are technical changes or even corrections. Others are policy issues he cares about, but perhaps not so important that he will veto the budget just because they fail to pass.

One dilemma Democrats might create for him – one easy to predict – is to agree with the Governor and dump the digital sales tax but reject his attempt to remove language related to the Regional Greenhouse Gas Initiative. To rejoin RGGI means the related carbon tax on electricity is also restored.

And while Youngkin vetoed two bills that create the opportunity for additional local sales taxes for schools, following a referendum, both passed with enough votes to override that veto. If that override happens, complaints about the schools being underfunded become even more ludicrous, and a continued budget standoff is even more inexcusable.

Unfortunately, these budget standoffs have become so commonplace in Virginia that the public is bored with them, not paying attention, and the mainstream media coverage of the Assembly is a whisper of previous years. The assumption is somebody will blink, and disaster will be averted. To assume that this time would be a mistake. The atmosphere is pure poison compared to past disputes.

The liberal group that did the budget comparison, the Commonwealth Institute, is a good example. The numbers on their spreadsheet appear accurate, but the rhetoric accompanying it is pure partisan gamesmanship. In December, when Democrats were pushing income tax increases in committee, that group strongly attacked any attempt to raise or expand the sales tax as regressive, tougher on the poor. They were correct about its disparate impact. Now they claim it was a good idea all along.

And the same press release points to a grand total of $174 million in discrepancies between the Governor’s proposal and the approved Assembly budget (this was before they had done their spreadsheet.) While both the Governor’s proposal and the Assembly proposal represent major spending increases over the current budget, the slight disparities in his plan are presented as “harmful cuts.” A budget fully $25 billion larger in just a single two-year cycle, and $65 billion larger than four years ago, is dismissed as riddled by “cuts.”

Nothing is cut. The Democrats just want to raise taxes to spend more. That will be why Virginia employee pay and retirement checks and state services are threatened after July 1, should reason not override partisanship this week.

Unlike many other states, Virginia has not amended its current regulation to incorporate the new version, and the old ACC I rules expire at the end of 2024. Leaving the California regime returns Virginia to regulation under the federal Environmental Protection Act, which is also proposing to limit the sale of gas vehicles, but so far is not seeking to eliminate them.

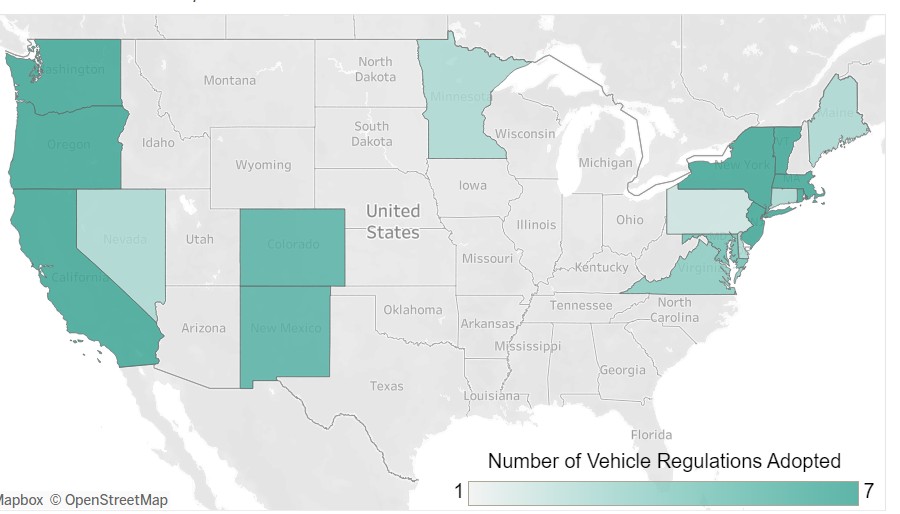

Under the federal Clean Air Act, California is the only state allowed to set air emissions standards more stringent than federal rules, but all other states are allowed to choose whether to follow California or comply with the EPA. More than a dozen states are following California. Some have also adopted its rules for heavier vehicles, but Virginia never did.

In a formal advisory opinion, Miyares states that nothing in state law requires the Air Board to update the regulations it adopted in 2021 to remain aligned with California. As with the statute on RGGI, the operative verb in the key sentence is “may” and Miyares writes: “The use of the word “may” – as opposed to “shall” – in a law evinces discretionary intent.”

Perhaps the bill authors in 2020 and 2021 never contemplated that their party would lose the Governor’s Mansion, so they were comfortable leaving the discretion with the executive branch. The statute on adopting the California air rules does include more instances of the word “shall” and will lend itself to a sharper argument over mandate versus discretion.

As with the dispute over RGGI, the bottom line is this issue will be back in front of the voters when a new governor and new House of Delegates are chosen in 2025. The parallel, less restrictive EPA regulation will also likely go away with Republican success in federal elections in 2024. A second Biden Administration would push them through. As the saying goes, elections have consequences.

This decision will have major consequences for the nation’s automobile manufacturers and their Virginia dealers. The California regulatory scheme is another version of cap and trade, where manufacturers earn credits for electric vehicles that they sell in the various states aligned with California. How many gas-powered vehicles they can sell is determined by how many of those credits they earn.

If a lawsuit comes to challenge this decision, the automobile manufacturers may join with the environmental community to bring it. Tesla makes only electric vehicles and is thus able to sell its unused ACC II credits for major revenue. The pending lawsuit over RGGI was brought by a group making money off that scheme, and the manufacturers also have a big pecuniary interest.

The original 2021 bill to join ACC I was supported by the Virginia Auto Dealers Association, which cited concerns that its members would not be able to get as many EVs to sell if the state is not part of the California compact. That may prove to be the case, although in the three years since the projections of public demand for EVs have not been met. They were less than 10% of Virginia sales last year.

Early in the Youngkin Administration, the question of how Virginia would react to the adoption of ACC II was raised. Virginia Mercury reported at the time that the Attorney General’s Office was of the opinion the update would happen, apparently automatically. That is more grist for some courtroom mill.

In most other states that are part of the California compact, the new version of the regulations have already been adopted or are in the process of being adopted. The National Caucus of Environmental Legislators has tracked that, and noted that “states will need to initiate rulemaking to adopt the new, more stringent regulations.” As for Virginia, it included a link to that Virginia Mercury article indicating Virginia didn’t need to.

As of earlier this week, the state Department of Environmental Quality website indicated that compliance was plugging along, with no reference to any complications caused by California’s new version.

Unlike many other states, Virginia has not amended its current regulation to incorporate the new version, and the old ACC I rules expire at the end of 2024. Leaving the California regime returns Virginia to regulation under the federal Environmental Protection Act, which is also proposing to limit the sale of gas vehicles, but so far is not seeking to eliminate them.

Under the federal Clean Air Act, California is the only state allowed to set air emissions standards more stringent than federal rules, but all other states are allowed to choose whether to follow California or comply with the EPA. More than a dozen states are following California. Some have also adopted its rules for heavier vehicles, but Virginia never did.

In a formal advisory opinion, Miyares states that nothing in state law requires the Air Board to update the regulations it adopted in 2021 to remain aligned with California. As with the statute on RGGI, the operative verb in the key sentence is “may” and Miyares writes: “The use of the word “may” – as opposed to “shall” – in a law evinces discretionary intent.”

Perhaps the bill authors in 2020 and 2021 never contemplated that their party would lose the Governor’s Mansion, so they were comfortable leaving the discretion with the executive branch. The statute on adopting the California air rules does include more instances of the word “shall” and will lend itself to a sharper argument over mandate versus discretion.

As with the dispute over RGGI, the bottom line is this issue will be back in front of the voters when a new governor and new House of Delegates are chosen in 2025. The parallel, less restrictive EPA regulation will also likely go away with Republican success in federal elections in 2024. A second Biden Administration would push them through. As the saying goes, elections have consequences.

This decision will have major consequences for the nation’s automobile manufacturers and their Virginia dealers. The California regulatory scheme is another version of cap and trade, where manufacturers earn credits for electric vehicles that they sell in the various states aligned with California. How many gas-powered vehicles they can sell is determined by how many of those credits they earn.

If a lawsuit comes to challenge this decision, the automobile manufacturers may join with the environmental community to bring it. Tesla makes only electric vehicles and is thus able to sell its unused ACC II credits for major revenue. The pending lawsuit over RGGI was brought by a group making money off that scheme, and the manufacturers also have a big pecuniary interest.

The original 2021 bill to join ACC I was supported by the Virginia Auto Dealers Association, which cited concerns that its members would not be able to get as many EVs to sell if the state is not part of the California compact. That may prove to be the case, although in the three years since the projections of public demand for EVs have not been met. They were less than 10% of Virginia sales last year.

Early in the Youngkin Administration, the question of how Virginia would react to the adoption of ACC II was raised. Virginia Mercury reported at the time that the Attorney General’s Office was of the opinion the update would happen, apparently automatically. That is more grist for some courtroom mill.

In most other states that are part of the California compact, the new version of the regulations have already been adopted or are in the process of being adopted. The National Caucus of Environmental Legislators has tracked that, and noted that “states will need to initiate rulemaking to adopt the new, more stringent regulations.” As for Virginia, it included a link to that Virginia Mercury article indicating Virginia didn’t need to.

As of earlier this week, the state Department of Environmental Quality website indicated that compliance was plugging along, with no reference to any complications caused by California’s new version.