Virginia has been a leader in economic growth over the past five years

while many other states have yet to experience significant growth. So why is

it that Virginia does so well while other states continue to struggle? The latest

edition of the American Legislative Exchange Council’s “Rich States, Poor

States,” uses census data to explain why some states have seen economic

growth in the last decade while others have continued to see decline. Through

statistical and anecdotal evidence, the analysis makes a compelling case that

pro-growth economic policy is what really makes the difference in achieving long-

term growth in Virginia.

The new data in the fifth edition of “Rich States, Poor States” outlines

two sets of state rankings. The first ranks economic performance based on the

past 10 years of economic data such as income, population and job growth. The

second ranks economic outlook by using 15 policy variables that include tax and

regulatory burdens, recently legislated tax changes, and labor policy.

The 2012 ALEC-Laffer State Economic Competitiveness Index ranks

Virginia 3rd in the nation for economic performance and 8th for economic outlook.

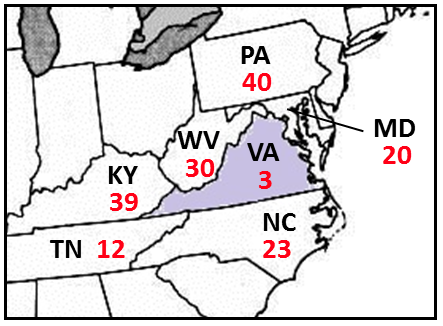

As shown in the map below, Virginia’s economic outlook ranking far

exceeds every single one of its neighboring states making Virginia the most

competitive state in this region. By keeping tax rates lower than surrounding

states, Virginia proves to job creators and taxpayers alike that they are open and

ready for business.

Economic Outlook Rankings of Virginia and Neighboring States

Virginia has a strong economic advantage in this region, especially when

it comes to attracting business and investment. Last year, companies such as

Northrop Grumman and Betchel Corp not surprisingly chose to set up shop

in Virginia instead of Maryland. Though Maryland did offer both companies

temporary tax incentives, Virginia offered long-term growth potential with a low

tax and regulatory climate.

For example, Virginia has a personal income tax of 5.75 percent and a

corporate income tax of 6 percent, whereas Maryland has a personal income

tax rate of 8.70 percent and a corporate income tax rate of 8.25 percent. In

addition, Virginia is a right-to-work state, whereas Maryland is a forced union-

state. Virginia also does not levy an estate or inheritance tax on its job creators,

whereas Maryland does. With these things in mind, it is no surprise that Northrop

Grumman, Betchel Corp, and many other business choose to grow and invest in

Virginia over Maryland.

Anecdotal and statistical examples such as these are used

throughout “Rich States, Poor States” to compare and contrast economic policy

in all 50 states. This publication is widely used by state legislators who want to

effectively drive economic growth and improve the standard of living for their

citizens, Democrat and Republican alike. It shows that states that allow the

government to heavily interfere with economic transactions through increased tax

rates, burdensome regulations, and bloated spending have lost economic vitality.

Many states such as Maryland have even seen taxpayers migrate to states with

lower taxes and more competitive business climates, like Virginia.

The beauty of the American experiment is that there are 50 “laboratories

of democracy” that can replicate the policies that have worked and avoid those

that have failed. ” States with suffering economies need to look to Virginia as a

proven model of success. The Commonwealth affirms that states cannot tax,

borrow, or spend their way to prosperity.

Like any other state, Virginia holds its economic future in its own hands.

By continuing to create an environment where businesses can invest, develop,

and create jobs, Virginia will keep leading the way for economic competitiveness

for states across the nation.

Download a free PDF of Rich States, Poor States online at www.alec.org/rsps

Jonathan Williams is co-author of “Rich States, Poor States” and Director of the

Jonathan Williams is co-author of “Rich States, Poor States” and Director of the

Center for State Fiscal Reform at the American Legislative Exchange Council

(ALEC).

Kailee Tkacz is an ALEC Research Analyst for the Center for State

Kailee Tkacz is an ALEC Research Analyst for the Center for State

Fiscal Reform.

- The Most Progressive Budget in Virginia’s History - December 21, 2019

- When is a Clean Water Act Permit Needed? - December 21, 2019

- Should U.S. Consider Modern Monetary Theory to Improve Economy? - December 21, 2019