Unlike many other states, Virginia has not amended its current regulation to incorporate the new version, and the old ACC I rules expire at the end of 2024. Leaving the California regime returns Virginia to regulation under the federal Environmental Protection Act, which is also proposing to limit the sale of gas vehicles, but so far is not seeking to eliminate them.

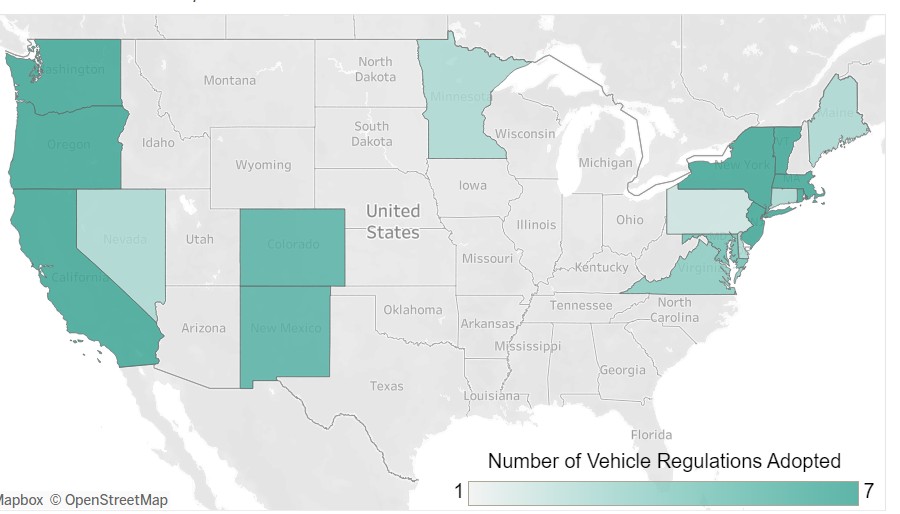

Under the federal Clean Air Act, California is the only state allowed to set air emissions standards more stringent than federal rules, but all other states are allowed to choose whether to follow California or comply with the EPA. More than a dozen states are following California. Some have also adopted its rules for heavier vehicles, but Virginia never did.

In a formal advisory opinion, Miyares states that nothing in state law requires the Air Board to update the regulations it adopted in 2021 to remain aligned with California. As with the statute on RGGI, the operative verb in the key sentence is “may” and Miyares writes: “The use of the word “may” – as opposed to “shall” – in a law evinces discretionary intent.”

Perhaps the bill authors in 2020 and 2021 never contemplated that their party would lose the Governor’s Mansion, so they were comfortable leaving the discretion with the executive branch. The statute on adopting the California air rules does include more instances of the word “shall” and will lend itself to a sharper argument over mandate versus discretion.

As with the dispute over RGGI, the bottom line is this issue will be back in front of the voters when a new governor and new House of Delegates are chosen in 2025. The parallel, less restrictive EPA regulation will also likely go away with Republican success in federal elections in 2024. A second Biden Administration would push them through. As the saying goes, elections have consequences.

This decision will have major consequences for the nation’s automobile manufacturers and their Virginia dealers. The California regulatory scheme is another version of cap and trade, where manufacturers earn credits for electric vehicles that they sell in the various states aligned with California. How many gas-powered vehicles they can sell is determined by how many of those credits they earn.

If a lawsuit comes to challenge this decision, the automobile manufacturers may join with the environmental community to bring it. Tesla makes only electric vehicles and is thus able to sell its unused ACC II credits for major revenue. The pending lawsuit over RGGI was brought by a group making money off that scheme, and the manufacturers also have a big pecuniary interest.

The original 2021 bill to join ACC I was supported by the Virginia Auto Dealers Association, which cited concerns that its members would not be able to get as many EVs to sell if the state is not part of the California compact. That may prove to be the case, although in the three years since the projections of public demand for EVs have not been met. They were less than 10% of Virginia sales last year.

Early in the Youngkin Administration, the question of how Virginia would react to the adoption of ACC II was raised. Virginia Mercury reported at the time that the Attorney General’s Office was of the opinion the update would happen, apparently automatically. That is more grist for some courtroom mill.

In most other states that are part of the California compact, the new version of the regulations have already been adopted or are in the process of being adopted. The National Caucus of Environmental Legislators has tracked that, and noted that “states will need to initiate rulemaking to adopt the new, more stringent regulations.” As for Virginia, it included a link to that Virginia Mercury article indicating Virginia didn’t need to.

As of earlier this week, the state Department of Environmental Quality website indicated that compliance was plugging along, with no reference to any complications caused by California’s new version.

Unlike many other states, Virginia has not amended its current regulation to incorporate the new version, and the old ACC I rules expire at the end of 2024. Leaving the California regime returns Virginia to regulation under the federal Environmental Protection Act, which is also proposing to limit the sale of gas vehicles, but so far is not seeking to eliminate them.

Under the federal Clean Air Act, California is the only state allowed to set air emissions standards more stringent than federal rules, but all other states are allowed to choose whether to follow California or comply with the EPA. More than a dozen states are following California. Some have also adopted its rules for heavier vehicles, but Virginia never did.

In a formal advisory opinion, Miyares states that nothing in state law requires the Air Board to update the regulations it adopted in 2021 to remain aligned with California. As with the statute on RGGI, the operative verb in the key sentence is “may” and Miyares writes: “The use of the word “may” – as opposed to “shall” – in a law evinces discretionary intent.”

Perhaps the bill authors in 2020 and 2021 never contemplated that their party would lose the Governor’s Mansion, so they were comfortable leaving the discretion with the executive branch. The statute on adopting the California air rules does include more instances of the word “shall” and will lend itself to a sharper argument over mandate versus discretion.

As with the dispute over RGGI, the bottom line is this issue will be back in front of the voters when a new governor and new House of Delegates are chosen in 2025. The parallel, less restrictive EPA regulation will also likely go away with Republican success in federal elections in 2024. A second Biden Administration would push them through. As the saying goes, elections have consequences.

This decision will have major consequences for the nation’s automobile manufacturers and their Virginia dealers. The California regulatory scheme is another version of cap and trade, where manufacturers earn credits for electric vehicles that they sell in the various states aligned with California. How many gas-powered vehicles they can sell is determined by how many of those credits they earn.

If a lawsuit comes to challenge this decision, the automobile manufacturers may join with the environmental community to bring it. Tesla makes only electric vehicles and is thus able to sell its unused ACC II credits for major revenue. The pending lawsuit over RGGI was brought by a group making money off that scheme, and the manufacturers also have a big pecuniary interest.

The original 2021 bill to join ACC I was supported by the Virginia Auto Dealers Association, which cited concerns that its members would not be able to get as many EVs to sell if the state is not part of the California compact. That may prove to be the case, although in the three years since the projections of public demand for EVs have not been met. They were less than 10% of Virginia sales last year.

Early in the Youngkin Administration, the question of how Virginia would react to the adoption of ACC II was raised. Virginia Mercury reported at the time that the Attorney General’s Office was of the opinion the update would happen, apparently automatically. That is more grist for some courtroom mill.

In most other states that are part of the California compact, the new version of the regulations have already been adopted or are in the process of being adopted. The National Caucus of Environmental Legislators has tracked that, and noted that “states will need to initiate rulemaking to adopt the new, more stringent regulations.” As for Virginia, it included a link to that Virginia Mercury article indicating Virginia didn’t need to.

As of earlier this week, the state Department of Environmental Quality website indicated that compliance was plugging along, with no reference to any complications caused by California’s new version.

Latest posts by Stephen D. Haner (see all)

- Trump’s Energy Promises Face Hurdles in Anti-Hydrocarbon Virginia - November 20, 2024

- No, RTD, Hurricane Helene Not Proof of ‘Climate Change’ - October 3, 2024

- A Transparent Effort to Increase General Assembly Authority to Eliminate Hydrocarbon Fuels - September 26, 2024