During his four-year term, tax reductions approved by Governor Glenn Youngkin (R) will save Virginians just under $8 billion, and approximately $1.5 billion or more in additional annual savings after he departs. Most of the rule changes that have produced these benefits occurred in the 2022 and 2023 General Assembly sessions.

Then in 2024 the General Assembly stalemated over tax issues as Youngkin stymied a hard push from Democrats to increase several taxes, while Democrats spiked any efforts on the Governor’s part to expand on his tax cuts. A final budget compromise that left the tax rules basically unchanged was the best possible outcome in that environment.

This stalemate environment will not have changed for the 2025 Assembly, Youngkin’s final one. A legislative study commission that first met August 14 is heavily stacked in favor of Democrats, 9 to 3, and dominated by legislators who make all the spending decisions. Its work plan includes reopening the debate over expanding the sales tax to cover the digital economy, including the business-to-business provisions that were so controversial in 2024.

The data on the value of the Youngkin-era tax cuts come from page 14 of that work plan presentation. Most of the meeting was taken up with a primer on Virginia’s tax code. Legislators are usually better informed on how the money gets spent than on how it is raised by the state.

Along with the continued divide in goals between the parties – lower taxes for Republicans, more spending for Democrats – the national political environment also argues against major state tax policy changes in 2025. Virginia’s income tax rules are tightly tied to the federal rules, and most of the provisions of the 2017 Tax Cuts and Jobs Act will expire soon. Virginia should make no major changes until the next President and Congress decide what to do about those expiring provisions.

That doesn’t mean Virginia’s leaders should not try to make additional progress now. There are a few key things on which they should be able to find broad agreement.

The meeting of the study committee followed the summer joint meeting of the two money committees to hear Gov. Youngkin report the results of the fiscal year that ended June 30. Despite the foregone revenue from the tax changes, and $2 billion in rebates in 2022 and 2023, the state finished the year comfortably in the black. Some of the credit for that goes to very conservative revenue projections, which were based on the prediction of a recession that never materialized.

Comparing the FY 2024 results to those of FY 2020, four years prior, total general fund revenue was up by almost a third. That happened despite the major increases in standard deductions and an earned income tax credit for lower income workers. Total personal income tax revenues rose by about the same amount, just under one-third. Corporate income tax collections were 90 percent higher than four years ago. The state’s various cash holdings have basically doubled in four years, to more than $30 billion at the end of June.

The concerning news – and it does demand attention – was the anemic growth of sales tax revenue. Despite a burst of strong inflation sales tax revenue grew only 21% over four years. One of the Youngkin tax cuts removed the state’s 1.5% tax on groceries, but that only contributed a bit to the slow growth of sales tax revenue.

The argument that the economy is changing, and more and more dollars are being spent on tax-exempt services, including digital services, is a better explanation. Revisiting all the exemptions for services and for digital products makes sense, and it should be possible to agree on some adjustments. But this expansion of the sales tax should not be undertaken to support an increase in state spending.

To prevent that, any expansion of the sales tax should be coupled with at least some targeted reductions elsewhere, preferably trimming the personal income tax. The first step, long advocated by the Thomas Jefferson Institute and long ignored by legislators, is to index Virginia’s tax rate brackets (unchanged since 1990) to inflation.

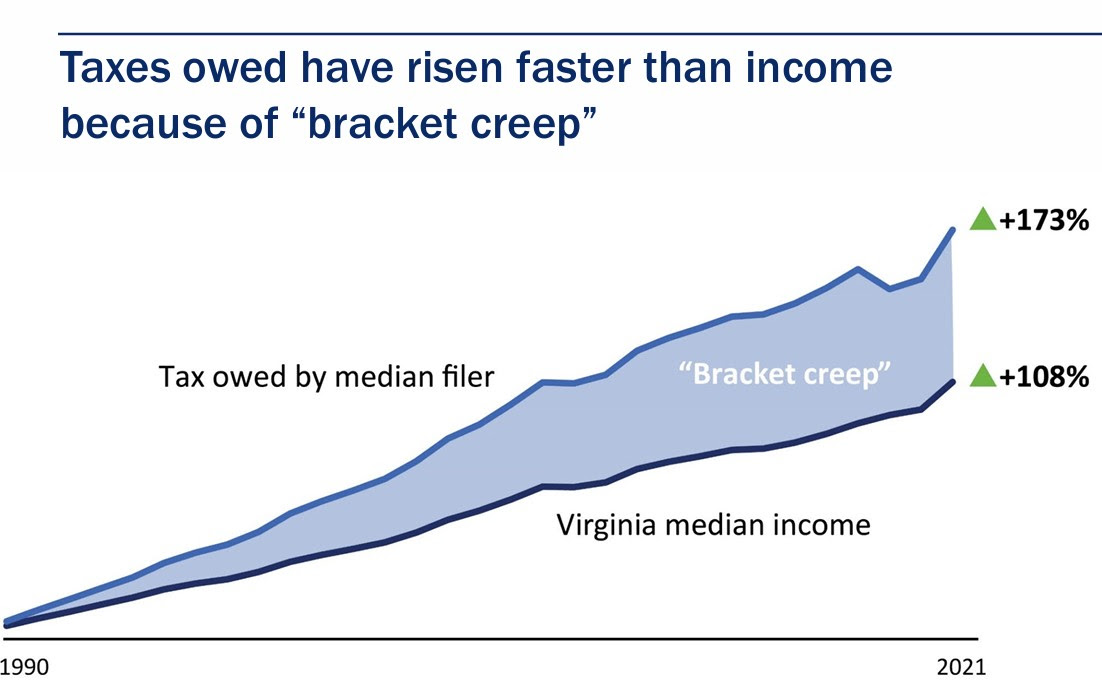

A third presentation to this first meeting of the study committee, this one compiled by the Joint Legislative Audit and Review Commission, gave a strong endorsement to the idea that adjusting our state tax code to inflation would be a step toward fairness. Leaving the brackets untouched has allowed more and more working-class Virginians to see a higher percentage of their income taxed at the maximum rate year after year despite their actual inflation adjusted income going down. The max tax of 5.75% kicks in at $17.000 of taxable income.

JLARC provided a very clear illustration of the “bracket creep” since 1990. Between 1990 and 2021, the median income tax filer saw their taxable income rise 108%. The tax they paid on that income, however, had risen 173%.

That is a major and very real tax increase just from inflation, a major hit to family budgets. It is the reason Virginia has become more and more reliant – too reliant really – on income tax for revenue. The wave of significant inflation in the past three years has probably pushed that closer to 200%. Along with setting a cost-of-living adjustment (COLA) for the brackets, the state should also adjust for inflation other deductions and personal exemptions.

As JLARC pointed out, the changes the legislature did approve in Virginia’s standard deduction greatly improved the progressivity of the tax code. If Youngkin could cap his efforts with the application of a true COLA, even if it starts modestly from the current tax brackets and deductions, his legacy for major tax reform in a single term would be secure. This should be the focus.

- Trump’s Energy Promises Face Hurdles in Anti-Hydrocarbon Virginia - November 20, 2024

- No, RTD, Hurricane Helene Not Proof of ‘Climate Change’ - October 3, 2024

- A Transparent Effort to Increase General Assembly Authority to Eliminate Hydrocarbon Fuels - September 26, 2024